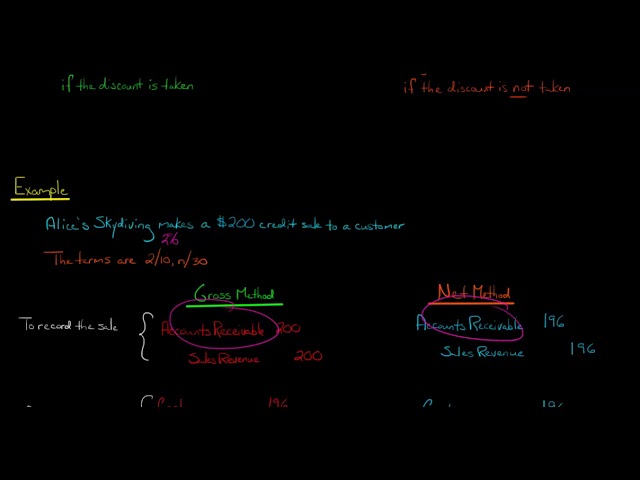

This video shows the difference between the gross method and the net method of accounting for Sales Discounts. Some companies offer discounts to customers for paying their bill within a specific period of time. It is very common to see, "2/10, n/30" on a bill, which means the customer will receive a 2% discount off the sales price if the bill is paid within 10 days, but if the bill is not paid within 10 days then the entire amount is due within 30 days. A company can account for these sales discounts using either the Gross Method or the Net Method.

This video shows the difference between the gross method and the net method of accounting for Sales Discounts. Some companies offer discounts to customers for paying their bill within a specific period of time. It is very common to see, "2/10, n/30" on a bill, which means the customer will receive a 2% discount off the sales price if the bill is paid within 10 days, but if the bill is not paid within 10 days then the entire amount is due within 30 days. A company can account for these sales discounts using either the Gross Method or the Net Method. Under the Net Method, we assume that the customer will receive the discount when we initially record the sale. Thus, we record Sales Revenue and Accounts Receivable as if the customer had taken the discount. If the customer does end up paying early and getting the discount, we simply debit Cash for the amount received and credit Accounts Receivable for the same amount. If, however, the customer does not end up receiving the discount, they will pay more than we initially recorded. We debit Cash for the full balance (without the discount) and credit the receivable. To make the debits and credits balance, we credit an account called "Other Income" or "Sales Discount Forfeited" or "Interest Revenue."

Under the Gross Method, we do not assume that the customer will receive the discount when we initially record the sale. Thus, if the customer doesn't receive the discount and pays the full amount, we simply debit Cash for the amount received and credit Accounts Receivable for the corresponding amount. If the customer does end up receiving the discount, however, we debit Cash for the amount received and credit Accounts Receivable. To make the debits and credits balance, we also debit an account called Sales Discounts. Sales Discounts will then be subtracted from Gross Sales on the Income Statement to yield Net Sales.

—

Edspira is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD.

Edspira’s mission is to make a high-quality business education accessible to all people.

—

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS

*

—

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts:

* Spotify:

* Website:

—

CONNECT WITH EDSPIRA

* Website:

* Blog:

* Facebook page:

* Facebook group:

* Reddit:

* LinkedIn:

—

CONNECT WITH MICHAEL

* Website:

* LinkedIn:

* Twitter:

* Facebook:

* Snapchat:

*Twitch:

* Instagram:

*TikTok:

0 Comments